Lifestyle creep, also known as ‘keeping up with the Joneses,’ refers to the tendency to increase spending as income rises. In this article, we delve into the phenomenon of lifestyle creep and explore its impact on personal finances. We discuss the different perspectives surrounding lifestyle creep, including the essential expenses it may encompass. Certified financial planner Jennifer Brown provides insights on how to manage lifestyle creep effectively, emphasizing the importance of saving and setting financial goals. Discover practical tips for striking a balance between enjoying the present and securing a stable financial future.

What is Lifestyle Creep?

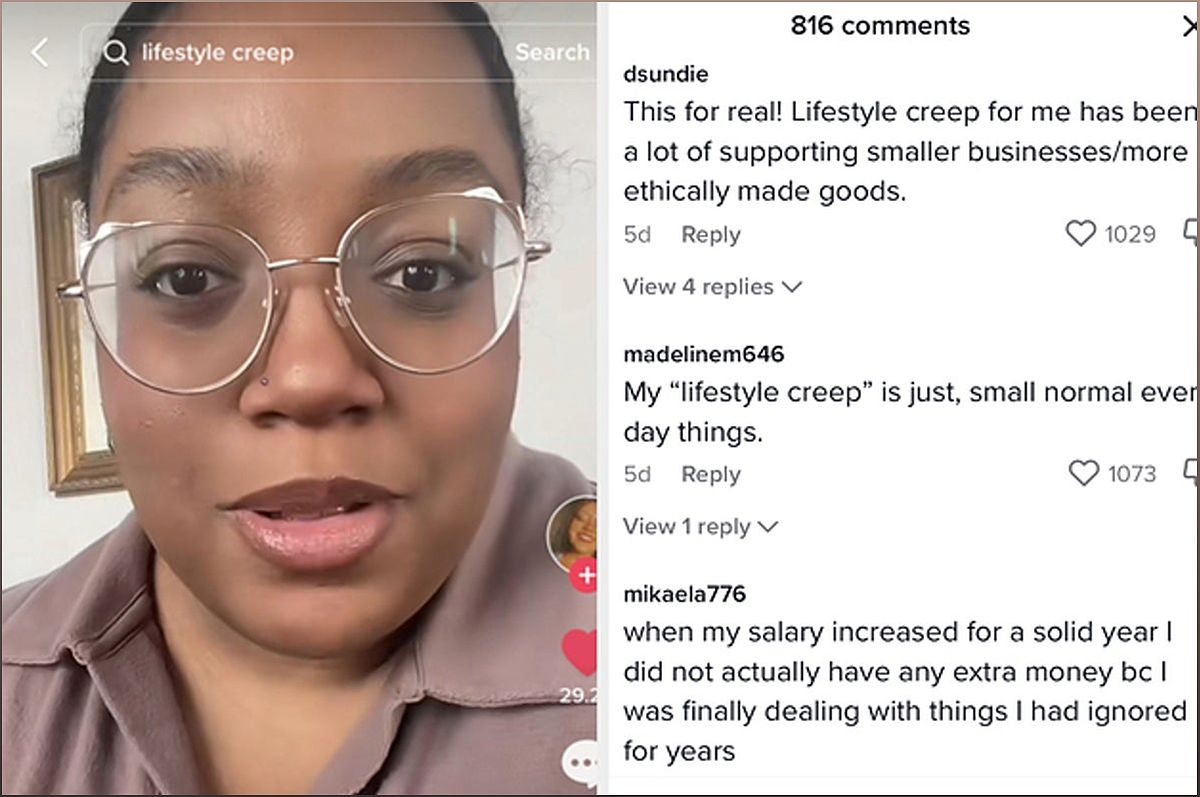

Lifestyle creep, also known as ‘keeping up with the Joneses,’ refers to the tendency of individuals to increase their spending as their income rises. It often involves upgrading one’s lifestyle and indulging in more luxurious expenses.

While lifestyle creep can bring temporary happiness and satisfaction, it can also lead to financial instability if not managed properly. It is important to strike a balance between enjoying the fruits of your labor and maintaining a responsible approach to money.

Different Perspectives on Lifestyle Creep

There is an ongoing debate regarding lifestyle creep, with some viewing it as a negative phenomenon and others arguing that it is a natural part of personal growth and self-care.

While some believe that lifestyle creep primarily involves frivolous spending on luxury items, others argue that it can also encompass essential expenses that were previously unaffordable, such as healthcare or necessary home repairs.

It is important to consider individual circumstances and priorities when evaluating lifestyle creep, as what may be considered excessive for one person could be a necessary expense for another.

Managing Lifestyle Creep Effectively

1. Prioritize Saving: Certified financial planner Jennifer Brown advises individuals to prioritize saving a portion of their increased income. This can involve setting up an emergency fund, paying down high-interest debt, or saving towards specific financial goals.

2. Set Financial Goals: It is important to have clear financial goals in mind to avoid excessive spending. Whether it’s saving for retirement, buying a house, or funding a dream vacation, having specific goals can help guide your spending decisions.

3. Practice Conscious Spending: Be mindful of your expenses and differentiate between wants and needs. Before making a purchase, ask yourself if it aligns with your financial goals and if it truly brings value to your life.

4. Automate Savings: Make saving a habit by setting up automatic transfers to a separate savings account. This way, you can ensure that a portion of your income is consistently being saved without having to rely on willpower alone.

By implementing these strategies, you can strike a balance between enjoying the present and securing a stable financial future.

The Importance of Financial Simplicity

Amidst the temptation to indulge in an extravagant lifestyle, it is crucial to maintain simplicity in your financial decisions. This involves being intentional with your spending and avoiding unnecessary complexity.

By embracing financial simplicity, you can focus on what truly matters to you and allocate your resources accordingly. It allows you to make informed decisions, reduce stress, and prioritize long-term financial stability.

Remember, financial simplicity does not mean depriving yourself of enjoyment but rather aligning your spending with your values and goals.

Striking a Balance for a Fulfilling Life

While it is essential to be responsible with your finances, it is equally important to enjoy the journey and find fulfillment in your life. Balancing financial growth and personal happiness is a delicate dance that requires self-awareness and conscious decision-making.

By aligning your spending with your values, setting realistic financial goals, and finding joy in both small and significant moments, you can create a fulfilling life that encompasses both financial stability and personal happiness.

Remember, everyone’s definition of a fulfilling life may differ, so it’s important to prioritize what truly matters to you and find your own unique balance.